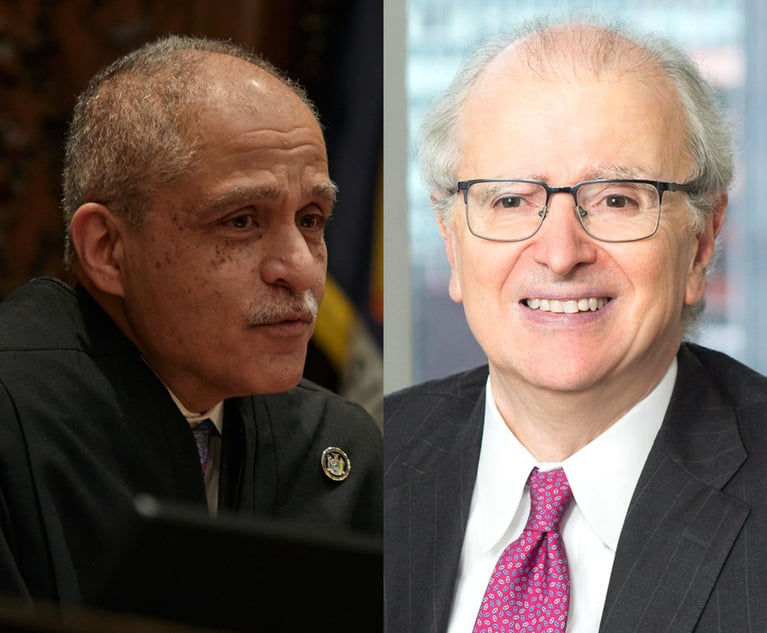

Litigation Funder Sues Plaintiffs Lawyer Over Clients' Alleged Nonpayment

The defendants "received payments totaling $31,650 while their suits were pending, and in the event of a breach of contract Legal Bay is entitled to three times that amount, plus attorney's fees and expenses," the suit states.

2 minute read